Emissions trading (EU ETS) is a market instrument used by the EU to reduce greenhouse gas emissions in a cost-effective manner, in order to achieve its targets and those of the Kyoto Protocol. Trading in emissions allowances (‘emissions trading’) refers to trade in emission capacity: the right to emit certain volumes of greenhouse gases. Purchasers and suppliers trade in emissions allowances, which results in a market price for CO2.

Emissions trading as a ‘cap-and-trade’ system

Emissions trading is a ‘cap-and-trade’ system. First of all a ‘cap’ is set: a limit on the total number of emissions. The cap is determined by a country's set targets. The emissions cap is gradually lowered, reducing the total volume of emissions. By 2020, emissions from sectors falling under the EU ETS must be 21% lower than the emissions in 2005. The European Commission has proposed a 43% reduction by 2030.

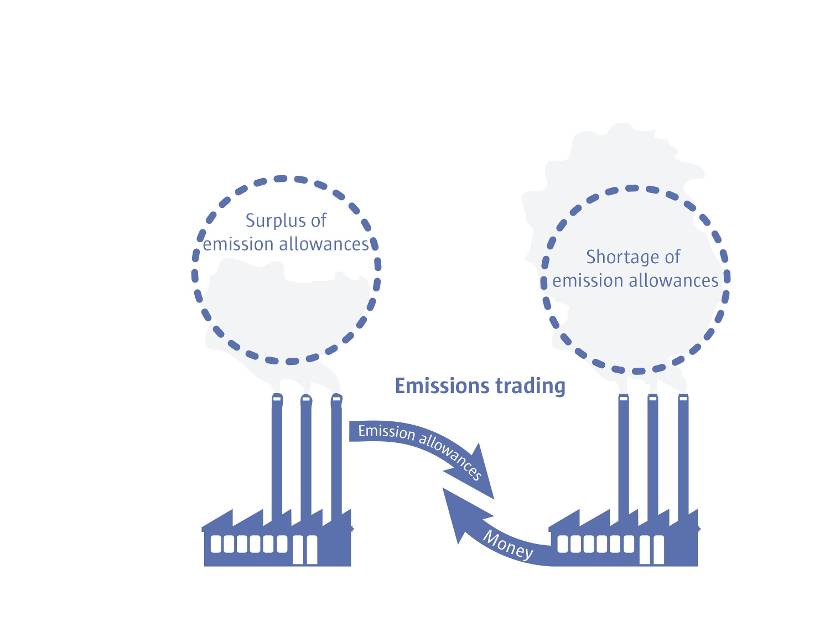

‘Trading’ takes place through transactions in units constituting the right to produce a fixed volume of greenhouse gas emissions. The number of available units is limited, giving them a financial value. Market supply and demand determines the value (and therefore the price) of units.

Using allowances

Most companies that participate in the EU ETS receive an annual allocation of free allowances. Each year, companies must surrender a quantity of allowances equal to their greenhouse gas emissions in tonnes. If companies produce more emissions than their available allowances, they must purchase additional units through trade or auction. Emissions may also be lower than expected and fall below the number of free allowances, e.g. due to company investments in emission-reduction measures. Companies will then have allowances left over, which they can use to trade. These companies can therefore decide for themselves whether it is more cost-effective to invest in clean technologies, or to purchase additional units.